Tokenomic

ETM/P blockchain is designed to be an underlying economic infrastructure for a Web3.0 ecosystem. It will be owned and controlled by its participants via a Decentralized Autonomous Organization (DAO).

ETM token is designed as a payment method as well as long-term reserve asset for the entire ETM/P ecosystem. It is designed to be of bounded volume, scheduled inflation. It will be used also for DeFi collateral and participation of future protocol governance.

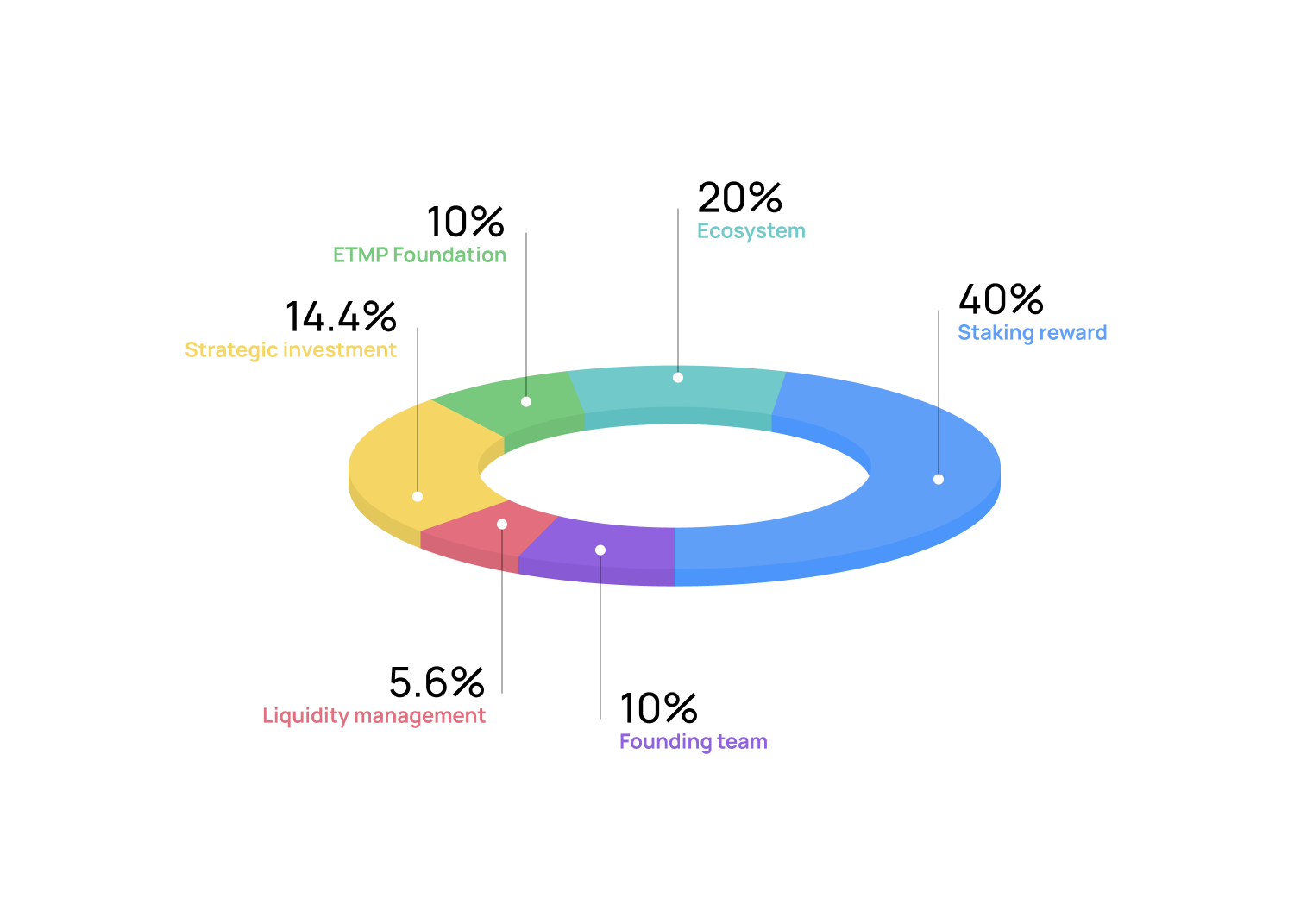

Total token supply 5,000,000,000

Staking reward 40%

Ecosystem 20%

ETM/P Foundation 10%

Strategic investment 14.4%

Liquidity management 5.6%

Founding team 10%

Staking reward schedule:

Staking reward schedule:

15% of the total staking reward is allocated in the first year, which incurs the inflation

16% of the remaining total staking reward is allocated in the second year, which incurs the inflation

17% of the remaining total staking reward is allocated in the third year, which incurs the inflation

Once the yearly inflation is fixed, the actual staking reward can be calculated and distributed using our dynamic equilibrium model.

The proportion allocated to the Ecosystem, the ETM Foundation and Strategic investment will be released by 10% at the beginning of the token circulation. The remaining 90% will be released at a linear rate in 45 months. These tokens are for ecosystem development to help bootstrap network effects and ensure a diverse and accessible community over the long term. Lockup mechanism has been implemented and the distributed tokens become liquid only gradually via a smart contract. This is to ensure: 1. the tokens are used for building a decentralized community with sustainable development; 2. to alleviate the downward price pressure due to inflation (flatten the curve).

The liquidity management allocation will be controlled by the ETM foundation and released at the beginning of the token circulation. This is particularly important for managing the price volatility due to possible wild speculations in the early phase of the project launching.

The token allocation for the founding team will be locked for 6 months and then released linearly in 10 months. ETM/P has been developed and brought to market by a team of interdisciplinary background. The lockup period is to incentivize them to be aligned.